LettsPay – Frequently Asked Questions

Client Accounting and Real-time Rent Processing for Letting Agents

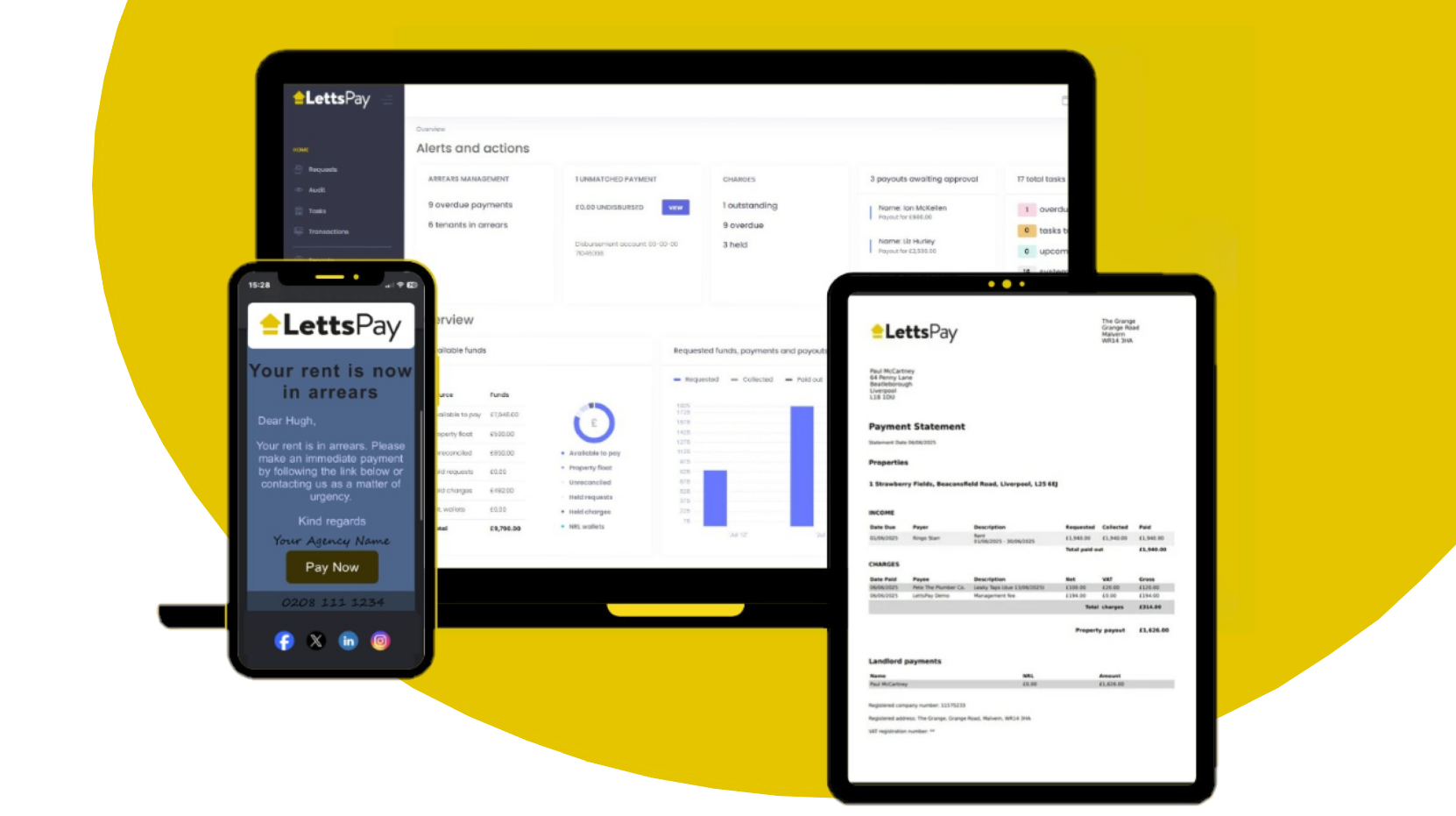

LettsPay is a real time client accounting and rent processing platform built specifically for letting agents and property managers in the United Kingdom.

It replaces traditional client accounts with individual FSCS protected landlord wallets, automated real-time rent processing, real-time reconciliation and built in compliance.

Below are the most common questions agents, landlords, auditors and CMP providers ask.

What is LettsPay?

LettsPay is a client money and real-time rent processing platform that automates rent collection, reconciliation and payouts while providing individual FSCS protection for every landlord. It removes manual client accounting and replaces it with real time banking and full audit visibility.

Is the LettsPay client account fully segregated?

Yes. Every landlord receives their own ring fenced digital wallet.

Funds are never pooled, mixed or co mingled.

Each landlord wallet is protected individually under FSCS.

This structure exceeds standard client segregation requirements.

Who holds and controls the funds?

Funds are held in Griffin bank (FCA Authorised), safeguarded client accounts in the Agents name.

LettsPay provides the technology layer to manage the money but does not hold client funds itself.

Tenant/Landlord money and funds never sit in a pooled client account.

Funds are ring fenced in FCA safeguarded accounts and protected under FSCS per landlord.

LettsPay never holds funds directly, so client money is protected and continuity controls ensure agents retain access to funds and records.

Client money remains protected and accessible should anything happen with the Agent, Bank or LettsPay.

Is LettsPay compliant with Client Money Protection requirements

Yes. LettsPay is fully compatible with Client Money Protection rules and is a Propertymark Approved Industry Supplier.

It is recognised by major CMP providers including Client Money Protect & Propertymark.

LettsPay also includes CMP for its agents as part of the platform which provides an additional protection layer for landlords.

What FSCS protection does LettsPay provide

Each landlord wallet is protected individually under the Financial Services Compensation Scheme up to the current FSCS limit of £120,000 per landlord.

This is significantly stronger than shared pooled protection models.

How does LettsPay process rent payments

Tenants pay rent by standing order or secure open banking payment link.

Payments are matched automatically to the correct tenancy.

Funds are placed instantly into the correct landlord wallet.

Reconciliation, ledger and statements are updated in real time.

How easy is it to produce a full client money reconciliation

Reconciliation is in real-time, continuous and automated.

Every transaction is matched at the point of receipt and payment.

You can generate full client money reports instantly with complete visibility of receipts,

payouts, balances and audit activity.

This removes spreadsheets, batch errors and timing gaps.

Does LettsPay create a full audit trail

Yes. Every system action is logged permanently.

This includes payments, approvals, adjustments, user access and statement generation.

Audit logs are available instantly for CMP checks, accountants and regulators.

Does LettsPay include AML, IDV, PEP and sanctions checks

Yes. Landlord biometric identity verification and AML checks are built directly into the platform.

These checks are required for CMP and also activate FSCS protection for each landlord wallet.

They are bank grade and take only a few minutes to complete.

Can landlords earn interest on funds held

Yes. Interest can be earned on funds held in landlord wallets.

This can be passed to the landlord or configured for the agent depending on relevant rules and regulations being met.

Does LettsPay work with Faster Payments

Yes. LettsPay operates on United Kingdom Faster Payments.

Payments run 24/7 and usually land in seconds.

Does LettsPay really automate reconciliation?

Yes. Every payment is automatically matched to the correct tenant and property. The balance always equals reality because LettsPay and the Griffin client account operate in the same live space. If the bank sees it, LettsPay has already processed it. That is why reconciliation isn’t a task anymore, just a screen you look at to say “approved.”

Is LettsPay compliant with client money regulations?

Yes. Compliance is the foundation of the platform.

Funds operate within FCA supervised safeguarded banking structures with full FSCS protection per landlord.

Reporting aligns with ARLA and RICS expectations.

Audit visibility is real time and complete.

Do I need a client account to use LettsPay?

Yes. We Fast track you to set up and run a BaaS powered Griffin Client Account in your name!

This is set up in your agency name through Griffin a UK authorised Bank as a Service provider.

LettsPay connects directly to that account to deliver true real time processing rather than delayed reconciliations.

How fast are rent payments cleared?

Payments are processed the moment they arrive.

Your dashboard updates instantly with live balances.

Approved payouts are sent via United Kingdom Faster Payments at any time of day including evenings, weekends and holiday periods.

There are no batch delays or overnight imports.

LettsPay is instant, it is like a window into the bank account.

Can LettsPay handle multiple landlords, branches and portfolios?

Yes. LettsPay supports single branch agencies, multi office groups and national portfolios without altering how you operate.

The structure adapts to your scale with far less need to add headcount.

Does LettsPay help with landlord payments and statements?

Yes. You approve payouts once and LettsPay handles the rest instantly.

Landlords receive instant payments with automatic statements.

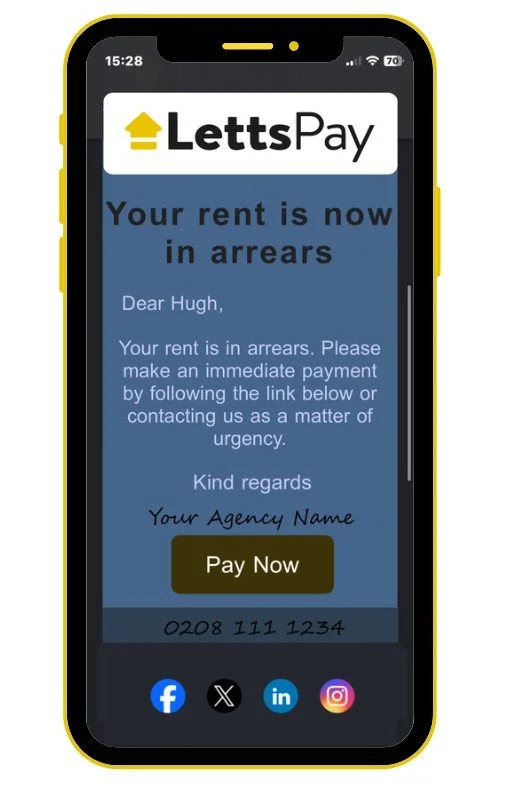

All communications can be branded to your agency.

We customise all communications with your narratives and brand.

Happy landlords mean they tell their landlord friends!

How simple is LettsPay pricing?

Pricing is fixed per property per month.

There are no bank charges, transaction fees or surprise add ons.

This gives agencies predictable monthly operating costs.

Can LettsPay integrate with my CRM / Software?

Yes. LettsPay connects with leading CRMs and industry platforms.

You do not need to replace your existing systems.

You simply modernise the financial layer beneath them.

Simply less chaos all round.

What does LettsPay do about arrears?

Missed payments are flagged instantly.

You see arrears in real time rather than days later after manual reconciliation.

This allows earlier intervention and better tenant engagement.

What reporting does LettsPay provide?

Landlord statements

Property statements

Tenancy Statements

Rent schedules

Arrears tracking

Client money summaries

Agency Fees

Full audit exports

NRL / HMRC / …and more

Reports are available on demand for accountants, compliance checks and HMRC.

Is LettsPay secure?

Yes. Security is built in at every level.

Bank grade encryption

User level permissions

Separation of duties

Two factor approvals for releasing funds

FSCS protection per landlord

Will LettsPay save me time?

Yes. Manual rent chasing, reconciliation and statement production are removed from your weekly workload.

That time is returned to service, growth and retention.

Can LettsPay handle deposits?

Yes. Deposits can flow through LettsPay with full traceability or be directed straight to the relevant insured deposit scheme.

Both routes are fully compliant.

Can landlords access statements online?

Statements are emailed automatically today and will be available inside the Making Tax Digital Landlord and Accountant Portal once launched. Same clarity, more convenience.

Can LettsPay handle contractor invoices and agency floats?

Yes. Pay contractors or reimburse agency fees directly from a float or the rent allocation. Every penny is logged transparently. Funds move instantly using UK Faster Payments so you can pay contractors in an instant when funds allow.

What happens if a tenant pays the wrong amount?

Unmatched payments are flagged instantly. No more detective work on bank references that look like licence plates. Each tenant pays into a unique landlord digital wallet so there really is only one place to look. No need to employ forensic accountants here.

Does LettsPay work for agencies of all sizes and stages?

Yes. Whether you manage fifty tenancies or five thousand, LettsPay scales without adding noise or stress. Growth becomes operationally effortless that you can budget for, no hidden surprises, bank charges or transaction fees. It’s all built in to one simple per property/unit fee.

Is LettsPay difficult to learn?

No. Most users are confident within days.

You receive onboarding, training, live support, a knowledge base and structured hyper care at launch.

How do I get started?

Book a demo tailored to your agency.

You will see how LettsPay compares to traditional client accounting and modern alternatives.

Once approved, your client account is set up, systems connected and landlords and tenants guided through the transition with no rent disruption.

Final message for agents

LettsPay is not a smarter version of the old way.

It is a higher standard entirely.

Real time rent brings instant clarity.

Automated reconciliation removes the noise.

Built in landlord IDV, AML, PEP and sanctions checks lock in compliance.

Agents stay in control.

Landlords feel protected.

Tenants trust the process.

Growth stops being expensive and starts being effortless.

If you want stability in a market that keeps shifting, we will show you what modern client accounting really looks like.

Book your demo and see it live.

Once you see it done properly, you will not go back.