CMP Paid by LettsPay + FSCS Per Landlord

Sometimes the most powerful messages are not loud or dramatic.

They are simple truths that finally give language to the worries agents feel but rarely express.

CMP Paid for agents and FSCS protection for each landlord do not sound earth-shattering on the surface.

But once understood, they signal something agents have been waiting for.

Certainty.

Personal protection.

The removal of silent client money anxiety.

Even agents who are happy with their current system that does the job still choose to partner with LettsPay

— because “good enough” is no longer good enough.

Not because something failed.

But because something finally made sense.

Trust Starts With Proof

Lettings is built on trust.

Agents earn it when landlords know their money is secure and traceable and protected at every step.

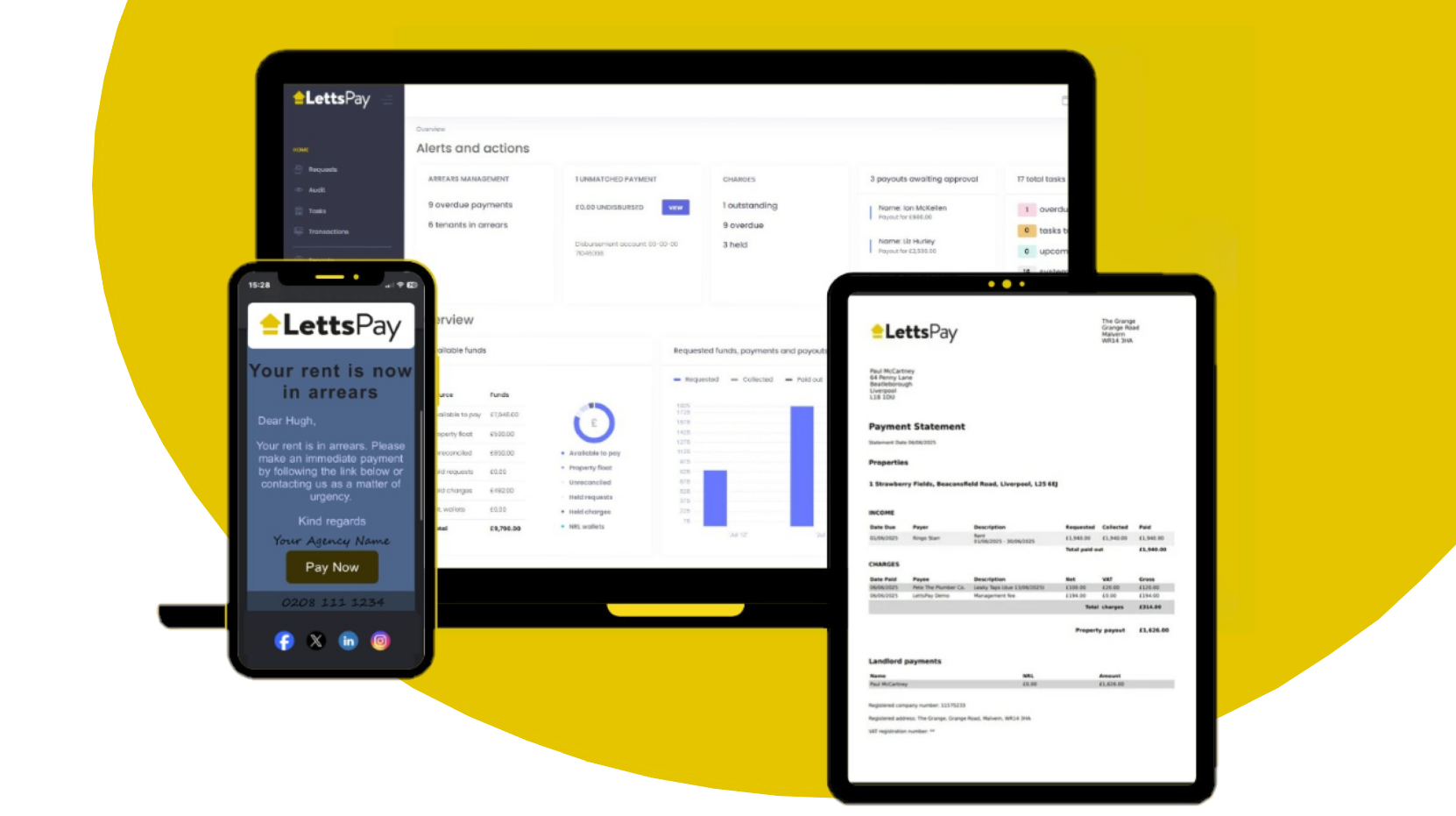

LettsPay is FCA registered and integrated with an FCA regulated UK bank with CMP recognised and ring-fenced client accounts.

Every landlord has their own ring fenced wallet which means the simplicity you see is backed by the complexity you never have to manage.

This is how real confidence is created.

1. Every Landlord Has Their Own Ring-Fenced Digital Wallet

Why? Because we can.

Each landlord’s funds are processed through their own digital wallet, completely separated from all other landlords and from your agency’s operational money.

What it means

The Client Account is opened in “Your Agency Name” — it is your account, not one of ours.

Landlords’ money is always individually accounted for, not pooled

Agents can prove separation instantly

No grey areas

This separation builds trust and removes the root cause of most client-money breaches.

FAQ -

Q: Setting up bank accounts is notoriously difficult. How hard is it to set up a ring-fenced landlord wallet in LettsPay?

A: If you can add a Landlord to a CRM then that’s all the effort it takes to set up a ring-fenced digital wallet for your landlord.

And if you’re comparing suppliers, here’s the question that really matters:

Who actually owns the client account the rent is sitting in — you the agent, or the software provider?

2. £120,000 of FSCS Protection — Per Landlord

Why? Because we can.

Every verified landlord’s funds are processed inside an FCA regulated UK bank account.

Our infrastructure qualifies each landlord for £120,000 of FSCS protection per landlord

Not shared across all landlords.

Not pooled.

No compromise.

The Financial Services Compensation Scheme is backed by the UK Government, which gives landlords a level of certainty normally reserved for banks and financial institutions.

What it means

Agents can offer each landlord personal FSCS cover

Landlords know their money is protected regardless of what happens to the agent or the bank

A powerful differentiator in landlord retention and acquisition

FSCS Protection increased to £120,000 as of 01.12.25

FAQ -

Q: But we already have FSCS protection with our current client account / automated rental payment platform.

A: That’s true — but your cover is applied per account, not per landlord. Which means every landlord’s funds are sharing the same pool of protection.

If you’re comparing suppliers, here’s the one question that cuts through the noise:

What is the FSCS limit that applies, and is it per landlord or per account in your setup?

3. Dual Protection through CMP Paid + Personal FSCS Cover per landlord

Why? Because we can.

If the agent fails CMP protects the landlord.

If the bank fails FSCS protects the landlord.

Two safety nets.

Two regulators.

One message.

This is not just protection.

It is a signal to agents that our systems are robust

and

It is a signal to Landlords that their agent has gone beyond compliance to offer certainty at an individual level.

FAQ -

Q: Which CMP provider qualifies me to get my CMP Paid by LettsPay?

A: Any of them. Stay with your preferred CMP provider, register as normal, and as a LettsPay customer on our 30-day rolling contract we cover the invoice.

No restrictions. No small print. No hoops.

If you’re comparing suppliers, here’s the one question that cuts through the noise:

Can you pay my CMP invoice, is FSCS pooled or per landlord and can you match or beat LettsPay price?

4. FCA Registered and Compliant by Design

Why? Because we can.

LettsPay is FCA registered, ensuring every transaction sits within a CMP compliant financial structure from the moment it is created.

We remove manual touch points and oversight. Compliance becomes automatic not something you have to police.

What it means

The bank and LettsPay move as one, no lag, no gaps

Automatic adherence to UK property client money rules

Fewer manual touchpoints and fewer opportunities for error

If you’re comparing suppliers, here’s the one question that cuts through the noise:

Does your system move client money in real time with the bank — or does the bank move the money first and the software catch up afterwards?

5. Automation Replaces Risk

Why? Because we can.

LettsPay automates the rent processing, allocation, and distribution in real time.

Every incoming payment, every allocation and every disbursement is processed and recorded without manual intervention.

What it means

No human error

Instant visibility of rent status and balances

Real-time reconciliation without any of the work

Real-time Automation is not just faster. It is safer.

FAQ -

Q: But my current system says it’s automated.

A: It probably is — but only after the money arrives. If the software has to wait for a scheduled update from the bank four times a day, five days a week before it can do anything, that isn’t real-time automation. That’s automation sitting on top of delay.

And if you are comparing suppliers, here’s the question that makes the difference:

Does your system move the money and update the ledger at the exact same moment — or does the bank move the money first and the software update later?

6. Real-Time Rent Processing, Payments and Reconciliation

Why? Because we can.

Payments run through the UK Faster Payments service — 24/7/365.

Funds clear instantly, tenants see transparency, and landlords and suppliers get paid in an instant.

What it means

Instant rent updates & open banking payments

Fewer calls and less admin

UK Faster Payment Service - near instant payments 24/7/365

A more informed team, happier tenants and happier landlords

FAQ -

Q: But my current system says it’s real-time.

A: If you are unable to pay your landlords 24/7/365, then it’s not real-time in the way you think or has been implied.

And if you are comparing suppliers, here’s the questions that make the difference:

When a tenant pays a holding deposit or rent into the bank at 3pm on a Saturday, how soon does it show up in the software?

What is the cut-off time for landlord payments to be initiated so funds land the same day?

7. Earn Interest on Client Funds*

Why? Because we can.

Client funds held in individual wallets can accrue interest which is a fairer and more modern approach than the traditional pooled account model.

What it means

Agencies can earn interest to re-invest in technology

Every landlord benefits from their own balance

Agencies can showcase fairer money handling

Demonstrates modern stewardship, trust and fairness

*Subject to rules & regulations being met

FAQ -

Q: Is earning interest on funds really worth it?

A: Many agents think so — but having the option matters. If interest is available, you should be able to choose whether it benefits your agency or your landlords, not lose it by default.

And if you’re comparing suppliers, here’s the question that exposes how it really works:

Does the money held in your system/client account accrue interest — and if it does, can you the agent keep it, pass it to landlords, or does someone else take it?

8. Built-In Identity, AML, PEP & Sanction Checks

Why? Because we can.

LettsPay verifies every landlord before funds even move.

IDV, PEP and Sanction checks are built into the landlord onboarding process.

What it means

AML compliance is automatic, not an extra job

No separate systems or external landlord checks required

Less admin, fewer risks and stronger controls

Earn additional revenue or offer a value-added service for landlords

Every verified landlord gets their own ring-fenced digital wallet with personal FSCS protection

FAQ -

A: I already do my landlord checks separately?

B: You shouldn’t have to. When you add a landlord in LettsPay, IDV is triggered automatically and the bank performs ongoing PEP & Sanction checks in the background — no re-keying, no third-party portals, no extra admin, LettsPay does it for you, seamlessly.

And if you are comparing suppliers, here’s the questions that makes the difference:

Does your system automatically screen every landlord for AML, PEP and sanctions before rent can ever be received or paid out — or do you simply remind the agent that AML, PEP & Sanction checks are their responsibility?

9. Making Tax Digital — Ready when you need it

Why? Because we can.

A dedicated Landlord and Accountant Portal is being built to support Making Tax Digital (MTD).

This will connect real time financial data directly with tax reporting tools.

What it means

Live portfolio data for the landlord and accountants

Seamless submissions to HMRC

One less thing for agents to worry about

10. Scale or Exit Without Friction

Why? Because certainty increases valuation.

When agents want to scale quickly or prepare for sale the strength of their client money process determines their agility and ultimately their valuation.

LettsPay provides separated, reconciled and fully evidenced client money in real time.

What it means

Cleaner due diligence

Higher confidence from buyers and investors

Easier mergers acquisitions or expansions

A higher multiple when you exit

LettsPay is not just a compliance tool.

It is a value multiplier.

(And quite possibly the difference between a buyer maxing out or tapping out).

The Bottom Line

LettsPay brings landlord protection and agent efficiency into one place.

It delivers more than compliance. It delivers control.

When a landlord knows their money is safer with you they stay with you.

That is what real growth is built on.

LettsPay removes the friction and chaos that has historically defined clunky, disconnected client accounting processes.

No more importing statements to begin your day.

No more manual reconciliations to end it.

No more uncertainty sitting in the background.

Smarter systems. Better control. Real results.

LettsPay strengthens and de stresses client money protection and protects your landlords funds with confidence.

Using a system that is just good enough or one that is good, but very expensive? Let’s have a chat and see how we compare >>>>>>